Mean-Reversion Trading Strategies in Python Course

This post contains affiliate links. An affiliate link means CSSA may receive compensation if you make a purchase through the link, without any extra cost to you. CSSA strives to promote only products and services which provide value to my business and those which I believe could help you, the reader.

In the last post I interviewed Dr. Ernest Chan who is the author of the Mean-Reversion Trading Strategies in Python Course that I will be reviewing in this post. Readers interested in enrolling in the course can follow this link and receive an additional 5% off by using the coupon code: CSSA5

The course is put together by Quantra/QuantInsti which provides algorithmic trading courses in a slick e-learning format for a wide variety of different topics including Momentum Trading Strategies which I covered in a previous post.

Review of Mean-Reversion Trading Strategies in Python

A long time ago when I first started trading using quantitative methods, I tried implementing statistical arbitrage strategies with a friend of mine using only an Excel notebook with a data feed. While I had a reasonable understanding of what to do, I didn’t have either the technical knowledge, practical experience, or programming/operational skills to do things properly. While the backtests look great, real-life trading made them look like a mirage in an oasis. Not surprisingly, this “half-assed” operation was a failure. If only I could have gone back in time and taken this course I probably would have had a much better chance of succeeding. The course teaches you both beginner and advanced stat arb techniques and shows you how to work with Python code and connect directly to Interactive Brokers.

The course teacher- Dr. Chan- is not some ivory tower academic or financial economist discussing arbitrage opportunities on paper or the classroom chalkboard, he is an actual hedge fund manager with a successful track record. As a result the course incorporates all the important reality-checks; from the obvious such as transaction costs, to the often overlooked such as considering short-selling availability and borrow costs, to the arcane such as importance of having non-negative weights in index arbitrage to avoid added exposure via stock specific risk. In my opinion this is why quants should strongly consider taking courses on Quantra/QuantInsti if they want to at the very least avoid beginner mistakes that cost a lot more money than the cost of taking a course.

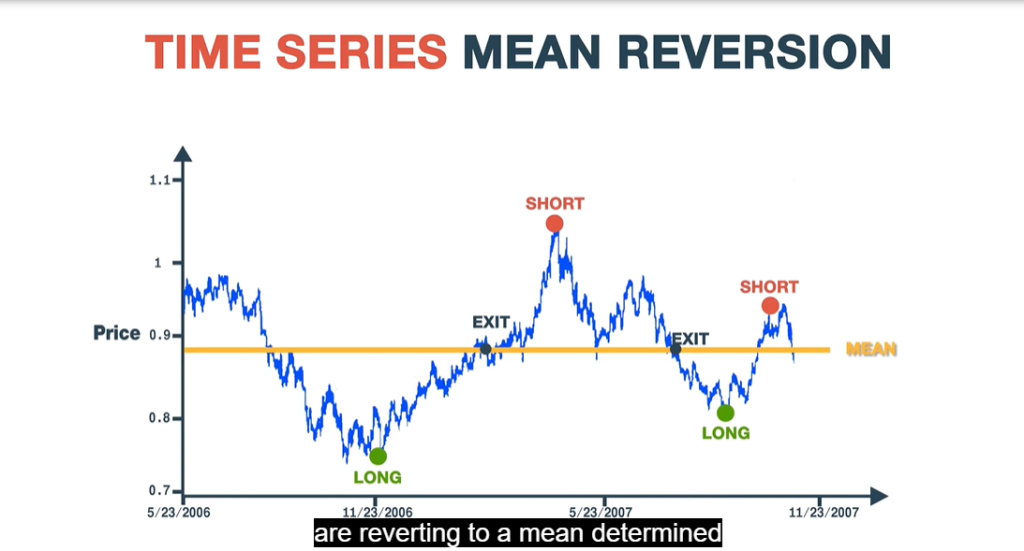

The course starts out defining stationarity and then relates this to a mean-reversion trading strategy. Various statistical tests such as the Augmented-Dickey-Fuller (ADF) test are presented along with both the requisite mathematics as well as code for calculation in Python. Then basic mean-reversion strategies are presented such as those that use Bollinger Bands or Z-scores that can be applied to stationary time series. This is extended to creating an actual portfolio of positions and how to manage this using signals to also calculating P/L. I liked the fact that an explanation was provided for why you would use statistical tests for stationarity prior to testing trading strategies since the majority of traders move immediately to backtesting.

Dr. Chan then discusses the Johansen test as a more versatile test to ADF and shows how to use the eigenvectors calculated for a wide variety of applications. The cool stuff included how to run arbitrage for triplets (3 stocks at a time) to basket arbitrage. Half-life calculations and their applications was also an important part of the content (this is often explained poorly by many sources but not in this case). I liked that the course covered risk management and also how to deal with broken pairs- something that everyone needs to know. Guidance was also provided for the best markets for pair trading. The course concludes with cross-sectional mean-reversion strategies which have been covered a lot on this blog. Python code for everything is covered in this course as well as how to apply turnkey approaches immediately in Interactive Brokers.

Overall if you are looking to get into stat arb whether at the firm level or for yourself this is a great primer. While it doesn’t show you any secret sauce, it gives you all the technical and practical coding knowledge as a foundation to developing your own. So if you are already very experienced this course probably isn’t for you. But if you are experienced but lacking in the technical/practical side you should definitely consider taking the course. There is also a Quantra community to help answer questions and build networks. Hats off to Dr. Chan and the very talented team at Quantra/QuantInsti for putting this course together.